Vananam launches Alternative Investment Platform 2.0 and Plans to raise Rs 160 crores (USD 20 million) in New Funding

ANI PR Wire

15 Nov 2022, 15:45 GMT+10

Bangalore (Karnataka) [India], November 15 (ANI/NewsVoir): Bangalore-based FinTech startup Vananam, which offers a platform for alternate investment options, is scripting success stories with its latest version, 2.0.

Founded by Keshav Gopaldas Inani in 2021, the company provides alternative investment solutions for all. These investments include startup equity, venture capital financing, working capital financing, invoice discounting, and revenue-based financing.

Within a year of coming into existence, Vananam has helped raise angel rounds for over 12 startups. These funds have ticket sizes ranging from Rs 50 lakhs to Rs 5 crores. Vananam has clocked a GMV of 800 crores (US USD 100 million) in the last eight months. For Vananam, the upcoming months look quite positive.

According to INC42, the Indian FinTech market opportunity is expected to be worth US$2.1 trillion by 2030. India currently has 22 unicorns in this space. Neobanking and lending tech are the two major segments in the FinTech market.

The market for alternative investment platforms is heating up significantly in India. Players like Kredx, Jiraff, Grip Invest, and Tyke have been providing similar services to retail investors.

Vananam has raised funds for reputed organisations to meet their financing requirements. It has helped medium-sized and large organisations raise working capital funds through invoice discounting and revenue-based financing. The firm is in advanced talks with large organisations about fulfilling its financing requirements in the domestic and foreign markets.

The market for alternative investment platforms could be the next area of opportunity for startups to explore. The Reserve Bank of India published household financial savings data based on select indicators last month. Deposits with banks remain a significant form of savings in India. As of March 2022, savings held in fixed deposits stood at 48.9 per cent of the gross domestic product (GDP). In comparison, savings through life insurance policies and mutual funds (MFs) stood at 22.3 per cent and 9.1 per cent of GDP, respectively.

There is a considerable opportunity once Indians begin investing in their assets outside of fixed deposits and life insurance policies. That is where the "alternative investment space" comes into play.

Assured by its success, internal sources claim that Vananam is raising capital to fund growth and operations. The information has come from a very reliable internal source. Vananam, which translates to "creating wealth" in Sanskrit, is in talks to raise Rs. 160 crores (US$20 million) in a fresh round of funding and expects to close by year's end. Vananam has already raised undisclosed amounts in angel and seed rounds. According to the news, the round is slated to finish by December, but given that it is now 130 per cent subscribed, the company may raise a larger round.

Vananam will be the most valuable player in the alternative investment market, with a predicted valuation of US USD 200 million. Platforms like Vananam teach investors how to move their resources from fixed deposits and insurance funds to alternative investment options with much higher returns.

This story has been provided by NewsVoir. ANI will not be responsible in any way for the content of this article. (ANI/NewsVoir)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Cambodian Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cambodian Times.

More InformationInternational

SectionWhite House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...

Over 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

US Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Sports

SectionOver 200 countries to broadcast NBA Abu Dhabi Games 2025

ABU DHABI, 3rd July, 2025 (WAM) -- The Department of Culture and Tourism - Abu Dhabi (DCT Abu Dhabi) and the National Basketball Association...

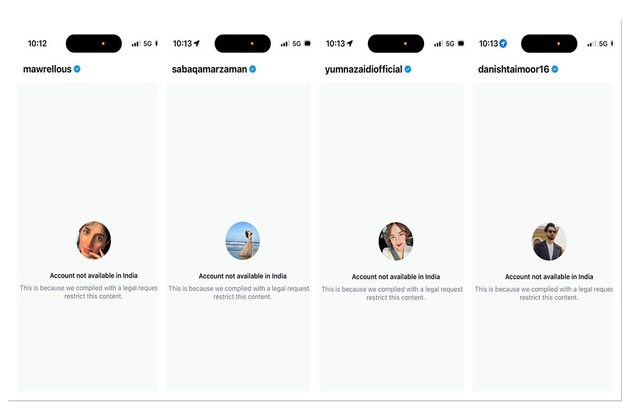

Pakistani celebrities' social media accounts remain blocked in India

New Delhi [India], July 3 (ANI): The social media accounts of several Pakistani actors and cricketers remain blocked after it was reported...

Jaipur to host inaugural Legen-Z T10 League from August 7

Jaipur (Rajasthan) [India], July 2 (ANI): The much-anticipated LEGEN-Z T10 League will be played from August 7 to August 13 at the...

Bengaluru Stampede: BCCI Ombudsman directs RCB, KSCA to file written replies to 'gross negligence' complaint

New Delhi [India], July 2 (ANI): The Board of Control for Cricket in India (BCCI) Ombudsman Justice (Retd) Arun Mishra has directed...

The Great Indian Kapil Show: Gautam Gambhir shows his funny side, Rishabh Pant gives his teammates 'devrani, jija' tags

Mumbai (Maharashtra) [India], July 2 (ANI): Actor-comedian Kapil Sharma is back with another episode of 'The Great Indian Kapil Show,'...

"Hard to believe": Shastri baffled by India's decision to rest Bumrah in second Test against England

Birmingham [UK], July 2 (ANI): Former head coach and cricketer Ravi Shastri didn't mince his words while expressing his discontent...