Important documents required for withdrawing funds from NPS after 1st April 2023

ANI PR Wire

27 Apr 2023, 12:45 GMT+10

New Delhi [India], April 27 (ANI/ATK): In February 2023, the Pension Fund Regulatory and Development Authority (PFRDA) issued a circular, mandating NPS subscribers to upload a few documents effective from April 1st, 2023. The pension body mentioned that uploading these documents would ensure timely annuity income payments.

PFRDA currently administers and regulates the National Pension System (NPS), which provides a steady income stream to subscribers after their retirement. Furthermore, NPS withdrawal entails a systematic process.

Under the existing rules, at the time of maturity, you must use a portion of the accumulated corpus - 40% to be exact - to purchase an annuity plan from an Annuity Service Provider (ASP). ASPs are approved by PFRDA, and offer numerous annuity options to provide a steady stream of income throughout your retirement years. The remaining 60% of the corpus can be withdrawn as a lump sum if it is less than or equal to Rs5 Lakhs.

Exiting from Government and Corporate NPS Schemes

To exit from government and Corporate NPS schemes, you can withdraw from the respective pension schemes before reaching retirement age. In the case of government NPS, government employees can exit once they reach the age of 60 years or earlier by fulfilling certain conditions. In the case of corporate NPS, the employees can exit upon turning 60 or earlier, as per the applicable exit policy.

Role of Annuity Service Providers

Under the National Pension System (NPS), Annuity Service Providers, such as LIC and SBI Life Insurance, play a crucial role. Once you reach retirement age or want to withdraw from NPS, a part of the accumulated corpus is used to buy an annuity from an Annuity Service Provider. These ASPs offer different annuity options, such as annuity for life, and annuity for life with return of purchase price on death.

These schemes ensure that you receive a regular income stream during your retirement years, based on the annuity option you choose, offering financial security and stability. Under the current rules, if you want to buy a pension plan for early retirement before turning 60, you must utilise 80% of the accumulated corpus to buy an annuity. Moreover, these ASPs use the NPS withdrawal forms subscribers provide at the time of exit at nodal officers or POPs to issue an annuity.

Documents to be Uploaded for Quick Distribution of Annuity Income

As per the PFRDA's circular, certain withdrawal and KYC documents need to be uploaded for the parallel processing of exit and annuity. This significantly reduces the time taken by ASPs to issue annuity policies. Furthermore, it enables faster subscriber servicing, and you can get the lump-sum amount quickly.

The documents you need to upload include:

* NPS Withdrawal/Exit form

* Identity and address proof, as mentioned in the Withdrawal form

* Proof of your bank account

* PRAN Card copy

Steps Included in the Processing of NPS Withdrawl or Exit Request

Whether you've opted for the government NPS scheme or a corporate NPS scheme, you must follow these steps to exit from NPS.

Step 1: You must log into the CRA system to initiate the online exit request.

Step 2: Once you initiate the request, you will see relevant notifications about e-Sign/OTP authentication, Nodal Office/POP authorisation, etc.

Step 3: After you initiate the request from the NPS account, details such as your bank information, address, nominee details, etc. are auto-populated in the NPS withdrawal form.

Step 4: You can choose the fund allocation percentage for annuity and withdrawable corpus, annuity details, etc.

Step 5: Using the penny drop verification, your bank account will be verified online.

Step 6: While submitting the exit request, you must upload KYC documents (identity and address proof), PRAN Card/ePRAN copy, and bank proof.

Step 7: All scanned documents must be legible.

Step 8: You can authorise the request using one of the following two options:

- OTP Authentication - Different OTPs will be forwarded to your phone number and email ID.

- e-Sign - You can e-Sign the request using your Aadhaar Card.

Conclusion

To exit from the National Pension System (NPS), you can withdraw from the pension scheme before or after reaching the retirement age of 60. Upon exit, you must utilise 40% of the accumulated amount to purchase an annuity from an Annuity Service Provider (ASP). The remaining amount can be withdrawn as a lump sum if it is less than Rs5 Lakhs.

As per PFRDA's latest circular, you can ensure quick distribution of annuity income by uploading a few documents w.e.f from 1st April 2023. These documents include the NPS withdrawal/exit form, identity and address proof, proof of your bank account, and your PAN Card copy.

This story has been provided by ATK. ANI will not be responsible in any way for the content of this article. (ANI/ATK)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Cambodian Times news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Cambodian Times.

More InformationInternational

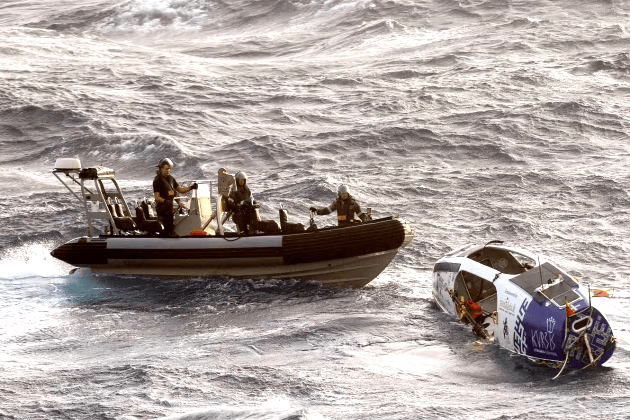

SectionAustralian warship rescues Lithuanian adventurer in Coral Sea

MELBOURNE, Australia: An Australian warship rescued Lithuanian adventurer Aurimas Mockus this week after he became stranded in the...

3,000 more active-duty troops sent to US-Mexico border

WASHINGTON, D.C.: The U.S. is sending about 3,000 more soldiers to the U.S.-Mexico border as President Donald Trump pushes to stop...

Members allowed to switch as Medicaid provider loses accreditation

ANNAPOLIS, Maryland: Maryland's largest managed care organization for Medicaid recipients has had its accreditation suspended, prompting...

US aircraft carrier in South Korea after North Korea's missile tests

SEOUL, South Korea: A U.S. aircraft carrier reached South Korea over the weekend, shortly after North Korea test-fired cruise missiles...

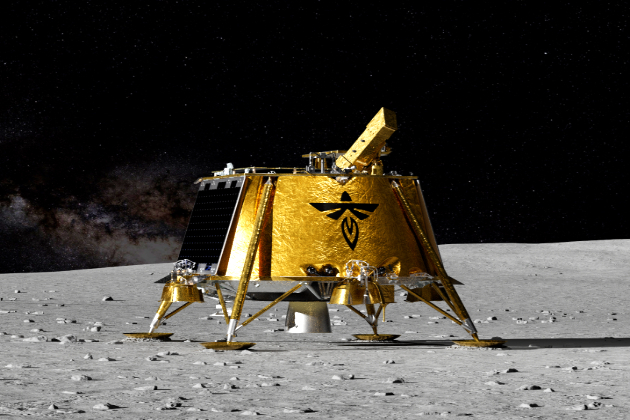

Marking a first, Firefly Aerospace's Blue Ghost lands on the moon

WASHINGTON, D.C.: Firefly Aerospace has achieved a major milestone in private space exploration, successfully landing its Blue Ghost...

NASA launches satellite to map moon's water resources

CAPE CANAVERAL, Florida: This week, a small NASA satellite was launched into space from Florida to find and map water on the moon....

Sports

Section"My dream is to help India win World Cup": India all-rounder Sayali Satghare

By Diptayan Hazra Lucknow (Uttar Pradesh) [India], March 7 (ANI): India all-rounder Sayali Satghare, currently playing for Gujarat...

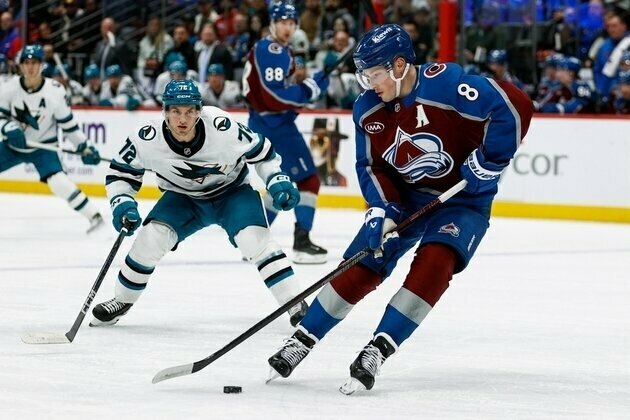

NHL roundup: Avs' Cale Makar logs career-best 6 points

(Photo credit: Isaiah J. Downing-Imagn Images) Cale Makar produced two goals and four assists for the first six-point game of his...

Seth Jarvis' goal in waning seconds lifts Hurricanes past Bruins

(Photo credit: James Guillory-Imagn Images) Seth Jarvis scored with 18.6 seconds remaining, lifting the Carolina Hurricanes to a...

Utah hires Alex Jensen, player in program's glory days, as coach

(Photo credit: Darren Yamashita-Imagn Images) Utah hired former Utes player Alex Jensen as its next men's basketball coach on Thursday....

NBA roundup: Lakers keep streak alive with OT win vs. Knicks

(Photo credit: Nathan Ray Seebeck-Imagn Images) Luka Doncic scored five of his 32 points in overtime, LeBron James added 31 points...

Oliver Bjorkstrand nets winner in Lightning debut

(Photo credit: Kim Klement Neitzel-Imagn Images) Newcomer Oliver Bjorkstrand scored the go-ahead goal in the third period of his...